As Donald Trump calls for overhauling the Affordable Care Act with a new health care system, one Republican senator running for an influential leadership position says the party should combine that pursuit with a major tax bill in the new year.

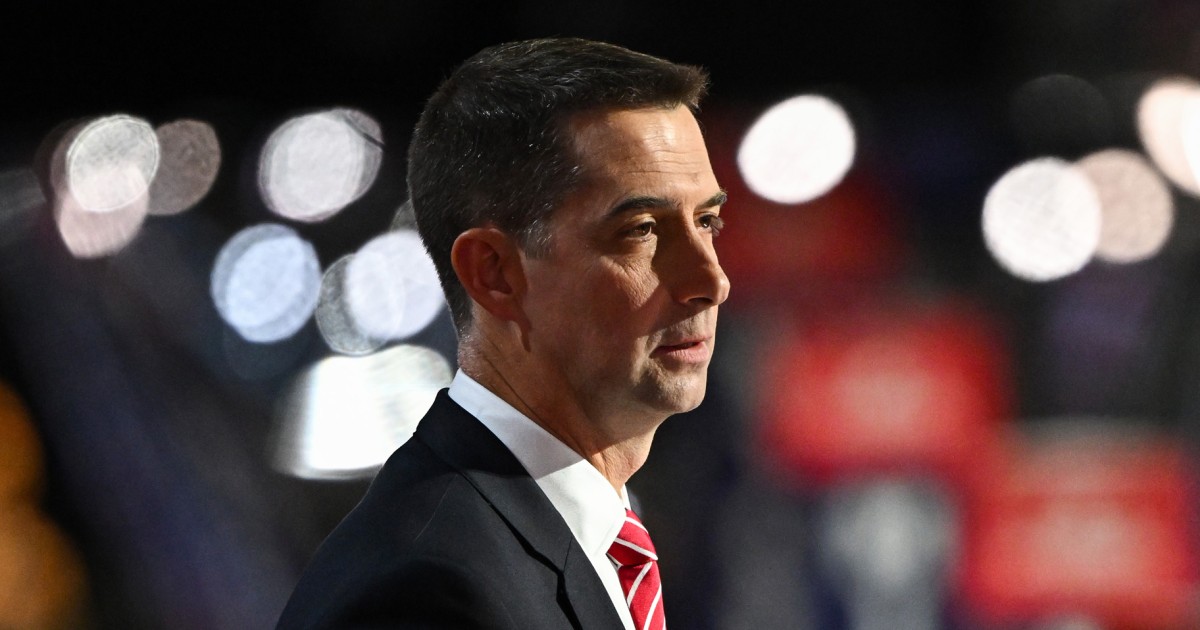

Sen. Tom Cotton, R-Ark., told NBC News after the vice presidential debate in New York Tuesday night that if voters elect Trump and GOP-controlled Congress, Republicans will be able to “make health care more affordable, more tailored and more personalized than the one size fits all option,” referring to the ACA, or Obamacare.

“We’ll have an opportunity next year, when it comes time to extend the Trump tax cuts, to adopt new policies that again will make health care more affordable and more personalized,” Cotton said. “Because a lot of health care in this country does go through our tax code. So I think that’ll be a very good opportunity next year.”

Republicans are widely eyeing an extension of the Trump tax law as major portions of the 2017 measure expire at the end of next year, calling it necessary to prevent a tax hike on Americans.

Cotton, who is running to the be No. 3 Republican senator next as part of a leadership shuffle, said the GOP can attach health care changes to an extension of the Trump tax cuts through the filibuster-proof “reconciliation” process on spending and taxes; that would allow them to pass both major policy bills at once with only Republican votes if they secure majorities in Congress.

“Because the Democrats have become so obstructionist on President Trump, the opportunity to pass major legislation next year will probably be centered on the extension of the Trump tax cuts from 2017 in addition to other measures,” Cotton said.

Trump has called Obamacare “lousy” and said he wants to replace it, but has not offered an alternative plan, saying during the Sept. 10 presidential debate he has “concepts of a plan” to remake the health care system without getting specific. The Trump campaign has not provided a timeline for when he will release a plan.

Kamala Harris is running TV ads attacking Trump’s push to reopen the ACA debate, saying he would seek to repeal the ACA, which would rescind subsidies that help Americans buy coverage and undo regulations that prevent insurers from charging people with preexisting conditions higher prices.

Even if they sweep the election, it’s far from clear Republicans would find enough support to revive their fight against the ACA, now that the law has grown popular. Many GOP lawmakers prefer to close that chapter after exit polls indicated that they paid a price in the 2018 and 2020 elections for trying to repeal it. But Trump’s influence over the party will likely grow if he wins this fall.

Sen. Thom Tillis, R-N.C., who sits on the Finance Committee that oversees tax and health care policy, said Congress will scrutinize Trump’s litany of expensive proposals in a tax bill. They include extending the 2017 tax cuts, eliminating taxes on tips and on Social Security income, among others projected to cost trillions of dollars.

“Great to have a discussion, but at the end of the day, we’re going to have to either get 51 or 60 votes — 51 through reconciliation or 60 votes to change these things,” Tillis said. “That’s when the pay-fors and the impacts have to be taken into account.”

Tillis was referring to the fact that Senate rules impose budgetary constraints on what can pass through the 51-vote reconciliation process, which Republicans will have to contend with.

“So we’ll take all these in but we can’t be everything to everybody all at once,” he said. “We’ve got to pass something, likely through reconciliation, and we’ll just have to see how those priorities play out — and how we pay for it.”

In 2017, Trump and Republicans in Congress tried to repeal the ACA but failed. Months later, Cotton successfully persuaded the party to use the separate tax law to zero out the ACA’s individual mandate (which required people to pay a penalty if they did not get insurance), a policy that went through the tax code.

Senate Minority Whip John Thune, R-S.D., who’s running to be the next Senate GOP leader, said the scope of reconciliation has expanded “significantly” and that it gives Republicans “an opportunity to address hopefully tax policy as well as perhaps some other achievable things.”

He didn’t suggest a health care overhaul would be one of them, but he made clear that a tax bill is inevitable to prevent a tax hike.

“Clearly, we’ve got to do something,” Thune said.

Garrett Haake reported from New York; Sahil Kapur reported from Washington.

Leave a Reply